Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

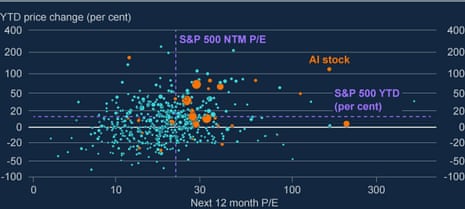

A Bank of England has also released a stock chart to show how ais stuence managed to find him in the US market, as sellers are made to anticipate future growth.

A chart, today's financial report, showing changes in the prices of the S&P 500 (y-axis)

As you can see, many of Ai's stocks are trading at a higher price than the rest of the street, a sign that higher profits are expected in the coming years.

As the bank explains:

The prices of many companies are based on the long-term availability of several years, which favors the companies that stay – the most available (see chart above).

The U.S.'s continuing US capital gains (Cape) yield – a measure of Equity Propeard (ERP) that shows how much money will be generated – is at its lowest point since the drop. Cape is an attractive level, but even calculated from the additional three-year yield, it is at its most stressful place in 20 years. Whether these benefits will be realized, or will prove unfaithful, it is not known.

Like we were blown away earlierThe bank is also concerned about the increase in loan production in the AI sector, indicating that this has increased until the second half of 2025.

This poses financial risks, it warns:

The deep links between ai pus and credit markets, and increase the correlation between those businesses, means that, to control the cost of the economy, the loss of the loan can increase the risk of default.

AI producers of money in the next five years can exceed $ 5t, according to some predictions, and I mean that these links will also grow.

So far, the conference market has bought the ai chip without complaint.

But … Boe fears this may not exist, and it shows that the cost of digging ORACLE Bad debt arose from the summer.

It says:

The bond market has taken this technology so far – IG Companion Bonds remain at their highest level in the last 15 years.

But secured loans and derivative loans related to companies can also help you adapt to specific business and/or future expectations.

For example, a five-year exchange rate, a company that has a lower cost than adequate protection of about 120 Five-year index – not changed immediately).

Big events

Andrew Bailey concludes by commenting that last week's budget will boost UK growth.

They say artificial intelligence should be the next technology to overtake fruit growth.

But it is important that the UK has policies that we can support growth,, he says:

If we do not raise the level of development, and thus the real growth of the economy, the whole process is very difficult. We see, the choices are overwhelming.

So we have, all of us, have to think about growth.

Another line from Bank of England Press Reference: Attention to the payment opportunities in Bals.

Governor Andrew Bailey told reporters in London that controlling the dollar had improved since the financial crisis but the central bank needed to “watch this very carefully”.

He said:

“We spend a lot of time at the bank in England just looking at … what will be like it will be or stress in those markets, and how can we feed the dollars as a system.”

Q: You say cyber threats are a threat to economic stability – are you concerned many British businesses are not prepared?

Andrew Bake He responds that “sadly” cyber has risen “to the top” of the league table since the financial crisis since the financial crisis.

It's a never-ending problem, he adds:

“You can't reduce cyber risk in a way that takes it off the table”.

There is evidence that the impact of this attack is building, Bake They continue to do so, so the bank is working with financial institutions to help secure them as well.

Q: There was a big shift in green hands ahead of the budget. Were the markets all about the budget, some of which were not accurate?

Budgeting is a difficult discipline in the market, that's the obvious word, Andrew Bake answers.

But they do not respond to the budget.

Q: Do you agree that the budget will be announced in September, as ex-Bank of England Andy Haldane has warned?

Bake He says there was a lot of anticipation about what would be in the budget – because of its importance, rather than just being told on a daily basis.

Businesses now know what's in the budget, so they can think on that basis.

Since he refused to invite two to comment on the budget position, the Bank of England governor of England Andrew Bailey can not refuse on the third (Have they been looking England beat Australia?)

Q: You mentioned the political attack on the federal government before, as well as the politics of the office to make the budget dangerous?

Bake reminding today's board of directors that there are good reasons why the office was created for the role of the budget made by George Osborne in 2010, he told the press:

The reason obler was created was to ensure that there was a source of independent forecasting and legal review.

It is important, it is important in many countries. Britain is not unique… There is nothing unusual about this at all.

That is why it is so important to be involved in these events, Bailey says, “Let's remember why it was done and its principles that were here.

However, it is not the bank that joins the “daily activities”, he adds.

Q: Have problems between savings in savings and responsibility so that its budget reflects reduced confidence in financial matters?

And they are threatening independent organizations like the dangerous obr?

Bake He refuses to participate, again, with the magazine, that it is “not at all appropriate” for the bank to respond to the plant or deposit.

Q: You are saying that financial risks are increasing, so when is the worst time to not release bank funds?

Andrew Bake It says that the question of timing is important, pointing to the results of the stress test (which shows the banks were stable).

They add:

We went through it, very economically, in recent years, and the banker has come through strong.

The reason is 'clarity and responsibility' to explain today's conclusion (the idea of reducing the number of borrowers must reserve it).

Q: Some of the various measures that were introduced after the 2008 crisis, such as the Bankers' Bonus laws, did the authorities go too far?

Bake He denies that the bank 'blocked' it in its time of crisis, insisting that all its actions were prudent.

They add:

We learn from experience.. So we are open to change.

Q: Is the Bank of England admitting the leak ahead of last week's budget to be “released”, As the budget responsibility office said yesterday. Are you scared of the obr yield and the summary about the creasure that seems to be circulating in the markets – could it be a request?

Andrew Bailey declined to comment on the matter, the bank is not involved.

Q: Has the bank taken any steps to prevent its reports from being accidentally downloaded quickly?

Protecting market information is very important, he replies. That's why the journalists melted in the room without a screen early this morning, he adds, so they can see what was released earlier.

Bake He says that the bank seemed to 'carefully' carefully 'report yesterday to obr error, to see what can be learned about the release.

The bank uses “various methods” to release information, Bake says, in addition:

We always want to learn from these experiences and we are looking carefully to see if there is anything we can notice, and act if necessary.

Q: Is there anything the Bank of England can do to deal with the problems with the UK retail trade, apart from caution and concern? (see the original post).

Andrew Bailey says the bank is pushing to strengthen the 'structure' in the wild market.

He adds that the change in the UK market is unusual, compared to other public markets, and that the bank monitors it “very closely”.

Q: Did the bank compromise its independence by putting up Rachel ReeVes billboards to help you grow, my friend KalyenAenA Makortefoff asks.

The ambassador of boe Andrew Bake he says it is “clear” because savings are good to establish the bank's view (in November 2024, Reeves wrote to the bank I recommend that you make sure that financial resources support economic growth).

Bake Reviewing economic stability and growth.

But, you think that the change is related to it – it should not hold more money than it needs (where it can be used in the real economy).

Q: Do you reserve the right to restore this capital before entering it, in 2027, if there are problems?

Bake It is said that the bank will continue to conduct tests, every two years of banking.

Therefore, “apparently” is very much driven by what happens, and what is measured.

The Bank of England is now asking questions from the press – it's the first house today's decision to relax the current rules on high street prices for several years.

Q: Can the cuttings of Bank in Bank Bionis sow successive crops?

The governor Andrew Bake The idea was made in light of the banking revolution, and today's financial crisis.

He insists it is a “cultural indicator”, and a “smart indicator of bankers' health”.

They are playing with the anxiety of the election, Bake says:

“I'm not worried about it in terms of where it takes the process. I think it's a smart thing to do.”

Q: Can you stop the bank just using this cut to add items?

Bailey says it doesn't come to that Bank of England tell the banks how to drive the bus.

But there are two relationships here, he adds: If banks are supporting the economy by lending, that will stimulate the economy, and the banks will benefit.